Author: Ms. Richa Agarwal

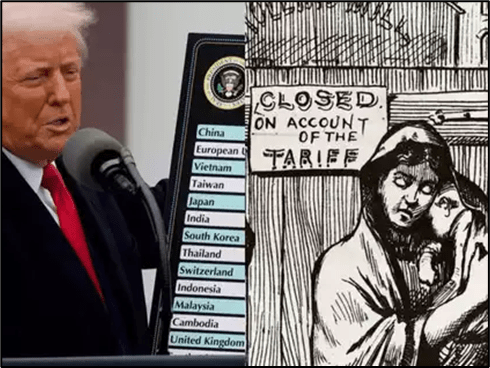

The potential for Trump’s return to power in the US created significant uncertainty in the market. Prior to the election, investors were optimistic, fueled by a robust economy and a belief that the market’s upward trajectory would continue. This optimism led to increased investments in stocks, shares, and derivatives, particularly in the corporate and industrial sectors. The economic climate seemed to be driven by a smooth, positive cycle. Until 1st February 2025, President Trump’s decision to impose a 25% tariff on imports from Mexico, Canada, India, and China dramatically shifted the market’s trajectory. This move marked the first significant decline in the S&P 500, Nifty Fifty, Dow Jones, and other key market indices since 2022. China’s retaliatory tariffs exacerbated the situation, triggering a global downturn in stock markets and investor sentiments.

Source: The Economic Times.

Amidst global uncertainty, foreign investors are pulling their money out of the Indian stock market, selling off their equities and shifting their investments towards government bonds and gold. This trend is reflected in the rising prices of both gold and long-term government bonds. The president’s policy intended to bolster domestic producers, is proving ineffective. Imposing tariffs cannot stimulate industrial productivity when costs are already higher. It’s undeniable that countries like China, with their economies of scale, can export goods at lower prices. Even if the US imposes tariffs on Chinese goods, China still holds the advantage, as they can simply raise prices for goods sold to the American market. Ultimately, American citizens are the ones who suffer the consequences of Trump’s policy. Looking at the Indian market, the corporate sector, particularly IT, pharmaceuticals, diamonds, and automobiles, are among the worst affected by this policy. These industries rely heavily on the American market, generating up to 50% of their revenue from it. This dependence creates significant uncertainty in the Indian market as well. These changes can have a cascading effect on other sectors in India. As demand for Indian goods weakens abroad, production and discretionary spending by industries decline, reflected in falling stock prices. This, in turn, impacts the real estate market, which is heavily reliant on IT professionals. A bubble has been created, and it needs to be addressed with careful attention, as history tends to repeat itself.

Source: The Times of India

India’s stance: The Indian government must step up to address investor sentiment by building trust and encouraging investment in the stock market, thereby stimulating private investment. Instead of introducing schemes to drive private investment, the government should focus on boosting consumer demand by reducing indirect taxes on commodities amidst rising food inflation. Inflation itself acts as a tax, and adding further taxes through indirect levies only exacerbates the situation. This situation significantly reduces citizens’ purchasing power for other goods and services, forcing them to spend more than half of their income on essential food items. Furthermore, it’s advisable for citizens to avoid investing in real estate currently. Prices are already high, a bubble has formed, and if a recession hits the US, it will likely impact India as well. Additionally, people should avoid investing in gold, as its price has surpassed 90% of its intrinsic value. Instead, it is wise to maintain an emergency fund (liquid money) as a safety net against any economic downturn. On 9th April 2025, the Reserve Bank of India announced a reduction of the policy repo rate by 25 basis points, targeting 6%. Amidst the turmoil in both domestic and international financial and trade markets, this reduction signals to investors to invest in the financial markets and stimulate private investments. This policy change is expected to filter down to the banking system, leading to lower repo rates and lending rates. As a result, private investors and consumers could borrow funds at a cheaper rate, potentially driving production and demand for goods and services. However, this is only one side of the story. A reduction in policy repo rates could lead to higher inflation, particularly in food prices. This increase could potentially exacerbate the situation. Additionally, with the US imposing tariffs, India’s IT and pharmaceutical sectors, heavily reliant on exports to the US, could face challenges. This could lead to an excess supply of goods and services, resulting in a lack of demand for workers. If worker incomes decrease, they may be unwilling to borrow even with lower interest rates. Therefore, the Government of India should intervene to support workers, preventing job losses and calming the job market. They should collaborate with other countries to bring projects to India and employ our workforce. However, these projects must be initiated quickly, or India may face future repercussions due to a weakened ability to absorb economic shocks.

This blog post is authored by Ms. Richa Agarwal, Postgraduate Student, Gokhale Institute of Politics and Economics, Pune, India.